ELMI offers insurers a cost-effective, accurate, and flexible language model built specifically to accelerate core processes from underwriting to claims.

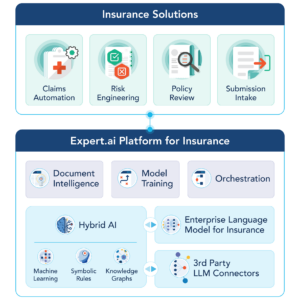

Expert.ai unveiled today its “Enterprise Language Model for Insurance” – ELMI, a cutting-edge innovation in domain trained language models, set to help insurers reach their process automation and digital transformation goals with the highest accuracy. By simplifying and powering the interaction with language data within the expert.ai Platform for Insurance, Insurers can access solutions that scale and take advantage of deep insurance domain expertise combined with the best and most cost-effective attributes of Large Language Models (LLMs) to automate core processes.

Through the expert.ai Platform for Insurance, ELMI supports key capabilities, including:

Generative Summarization: generate accurate summaries, condensing vast amounts of claim or policy information into concise insights, saving time and accelerating straight through processing or human review activities.

Generative Summarization: generate accurate summaries, condensing vast amounts of claim or policy information into concise insights, saving time and accelerating straight through processing or human review activities.

Zero Shot Extraction: extract crucial insurance data from structured/unstructured, handwritten/typed, good quality/bad quality sources with accuracy and automatically normalize output formats and add medical annotations such as ICD 9/10 medical codes.

Generative Q&A: answer questions quickly so underwriters and claims handlers can extract meaningful insights from proprietary case files by asking questions using natural language queries.

Walt Mayo, expert.ai CEO, said: “Delivering on our commitment to innovation and higher level of efficiencies in the insurance sector, ELMI sets a new standard for AI-driven language solutions. As part of the expert.ai Platform for Insurance, ELMI equips insurers with the generative AI tools they need to automate the complex landscape of language-driven processes, while also offering substantial cost savings.”

Unlike general knowledge large language models, ELMI is:

- Trained for Insurance: Eliminating the cost and complexity of training language models, ELMI is engineered with a deep understanding of the insurance domain, providing insurers with generative AI capability ready to tackle underwriting and claims processing challenges.

- Built for the real-world: ELMI is integrated into our end-to-end insurance solutions to meet the practical challenges of AI at scale across insurance workflows from underwriting to claims. Expert.ai’s purpose-built approach addresses critical shortcomings of general-purpose language models and brings the power of generative AI to improve accuracy and reduce costs.

- Cost Optimized: When compared to hosted token-based models, ELMI offers a more cost-effective solution, reducing expenses related to usage, hosting, running, and maintenance, while still delivering superior performance and accuracy.

- Secure and Compliant: ELMI is designed to ensure compliance with the most stringent governance standards and does not share sensitive insurance data.

- Cloud-agnostic: Offering the flexibility to deploy on any cloud infrastructure or on-premises, ELMI deployments easily meet insurer’s varying requirements.