Expert.ai has been named in the 2023 InsurTech100 in recognition of its AI Platform for Insurance that uses natural language processing (NLP) to power underwriting and claims solutions.

Expert.ai, the industry leader in AI-powered language solutions, has been named to the InsurTech 100 by research firm FinTech Global. The ranking celebrates the groundbreaking tech companies developing innovative solutions to the insurance industry’s most daunting challenges.

FinTech Global’s Director, Richard Sachar, commented: “The widespread availability of generative AI capabilities has opened the doors for even greater innovation within insurance. We’re entering a new wave of digitalisation and insurance firms need to be prepared. The InsurTech100 will help top-level insurance executives in discerning the tech pioneers revolutionising key areas like underwriting, pricing, distribution, and data analytics.”

According to FinTech Global judging panel, “The competitive landscape meant this year’s battle to earn a spot amongst the 100 InsurTech visionaries was intense.” A select group of analysts and seasoned industry specialists sifted through a comprehensive list of over 1,900 contenders presented by FinTech Global. The chosen few were acknowledged for their inventive technological applications either to solve a major industry challenge or to bolster efficiency throughout the insurance value chain.

“Digital transformation hits a roadblock in insurance processes that require understanding of domain language data present in policies, medical claims, CMS forms, risk reports, slips, etc. The expert.ai Platform for Insurance provides advanced AI language solutions that enable insurance companies to automate text-heavy processes with a human in the loop for the highest accuracy, objectivity and 24/7 coverage that can scale, increasing throughput and improving combined ratios,” said Keith C. Lincoln, expert.ai CMO. “We are thrilled to be included in the InsurTech 100 list as a recognition of our strong commitment to innovation and the value we are providing across insurance workflows.”

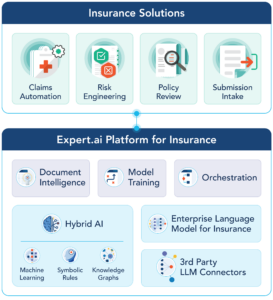

The expert.ai Platform for Insurance powers underwriting and claims solutions so that insurers can use natural language processing (NLP) to eliminate documents from review cycles, extract and augment critical data, and prioritize which submissions or claims need expedited review or to be assigned to a senior adjuster based on complexity.

Access our on-demand webinar “State of AI and Intelligent Automation in Insurance” to learn how you can leverage the expert.ai Platform for Insurance to intelligently automate claims management, risk engineering, policy review and comparison, and subscription intake while transforming your operations, reducing costs and improving combined ratios.