Risk assessments are complex, time consuming to produce and require expertise

While the result is always an overall risk assessment for a specific object (e.g., building, factory, production process, etc.), the underlying risk-grading methodologies  vary by the internal standards of the organization creating the report. The only way to consistently align standards is to analyze each risk report individually and translate it according to the in-house standard which is expensive, time consuming and prone to interpretation and error.

vary by the internal standards of the organization creating the report. The only way to consistently align standards is to analyze each risk report individually and translate it according to the in-house standard which is expensive, time consuming and prone to interpretation and error.

At expert.ai, we leverage natural language understanding to read all available documents and extract key information, enabling insurers to quickly identify risk exposure without the limitations of the traditional process (e.g., limited capacity, high level of subjectivity and expensive process, etc.). In doing so, organizations unburden risk engineers, freeing up time for them to allocate towards verifying more complex cases and helping underwriting teams more expeditiously turn around quotes for new policies.

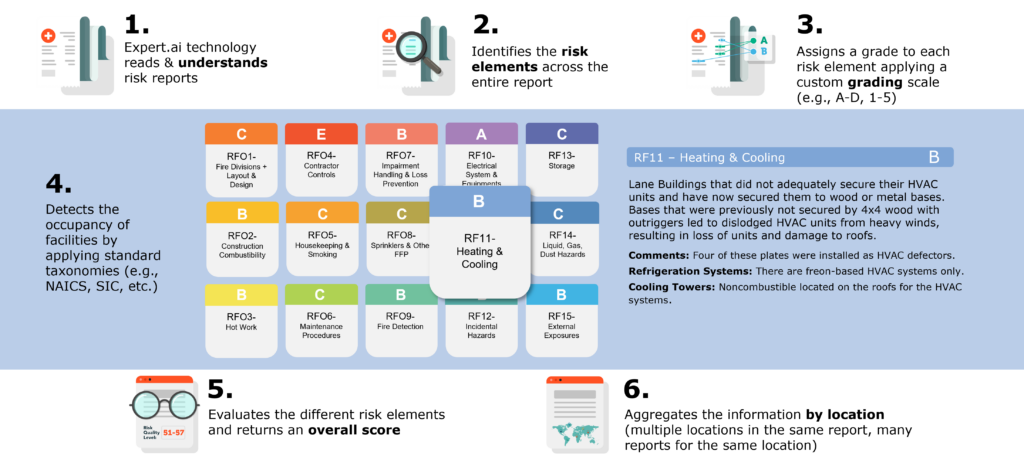

Read and Understand Documents

Our technology reads and understands all available documents that describe the facilities to be insured (e.g., the risk of fire for a specific property location).

Detect Risk Factors

Our technology detects risk factors across your entire report for each specific object (e.g., building, factory, production process, etc.).

Assign Risk Grading Score

Our technology evaluates every risk qualifier, assigns a grade to each, then returns an overall score.

Aggregate the Information

Our technology aggregates your information by location (i.e., multiple locations in the same report, or the same location in multiple reports).