Download the whitepaper below

There are few industries more reliant on text-intensive processes than that of insurance. Unfortunately, the documentation required of these processes has only become more complex, making them more onerous for underwriters to read and analyze. With processes such as risk engineering and policy review already slow and lacking standardization, insurers have turned to artificial intelligence — more specifically, natural language understanding — to unlock process efficiencies.

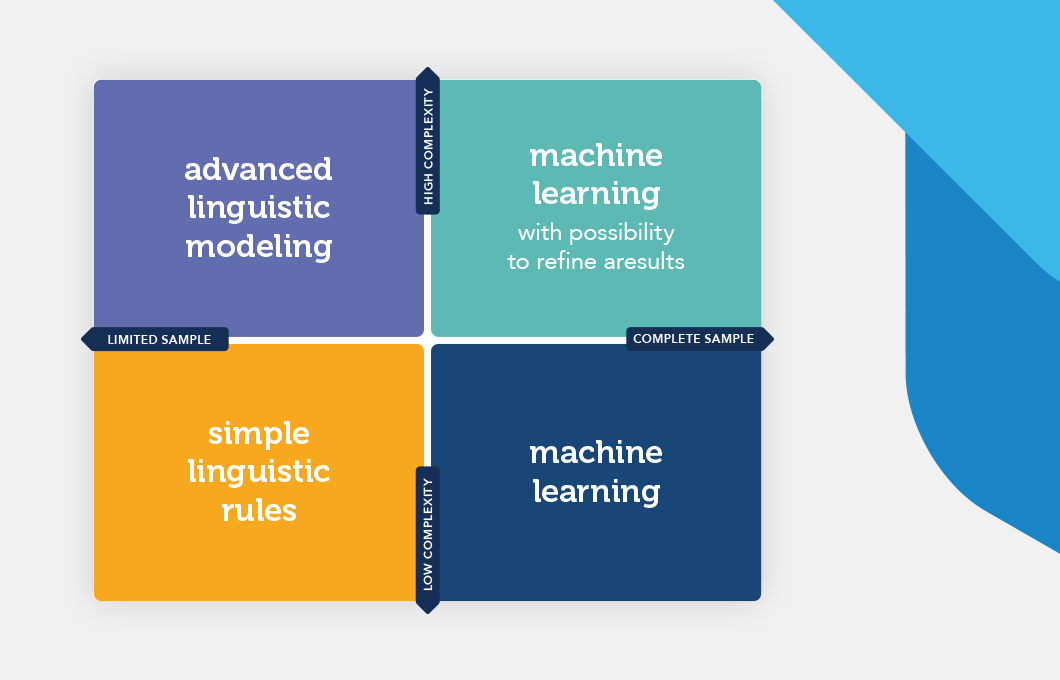

While their focus may be in the right place, there is much to consider when selecting an NLU solution. With no one-size-fits-all solution, insurance companies must find the right fit for their own challenges, but where do they start? The following white paper breaks down the various NLU approaches available to you and discusses the best-fit opportunities for each, so you don’t have to leave your AI decision to chance.

Download this white paper to understand:

- The two primary approaches to natural language understanding

- How to classify your use case to identify the ideal AI approach

- The capabilities of each NLU technology

- The core elements to a complete NLU solution